Digital installment plan

Do your customers need to sign paper and send it back via snail mail to agree on an installment plan with you? Are installment plans still handled manually by your customer support? Would you like to digitalize this customer journey for a much better customer experience?

The collect.AI platform has been extended with a digital installment plan feature. Your customers can agree, entirely digitally, to an installment plan on the landing page. You keep full control over the communication and customer relationship with our whitelabel solution. Your customers can choose the best fitting installment plan option and a suiting start date for the first payment. The possible installment plan options lie in acceptable limits defined by you.

Use cases in the market

Typical use cases for digital installment plans exist in the energy supply branch:

- Due to higher energy prices, a number of customers can not pay the yearly energy invoice at once. Therefore, you offer them to pay in e.g. 2 or 3 installments to solve their temporary payment problem. These are customers that could become loyal customers.

- The law requires energy providers to offer installment plans to customers that are within a basic supply when they are notified about an upcoming stop of energy delivery in written form. To this specific client group, you could offer installment plans with more options e.g., 2-18 months.

At the moment, these processes are often handled manually by the customer support. This is very costly and time consuming. With a digital option all of this happens automatically and customers can start paying the first installment earlier.

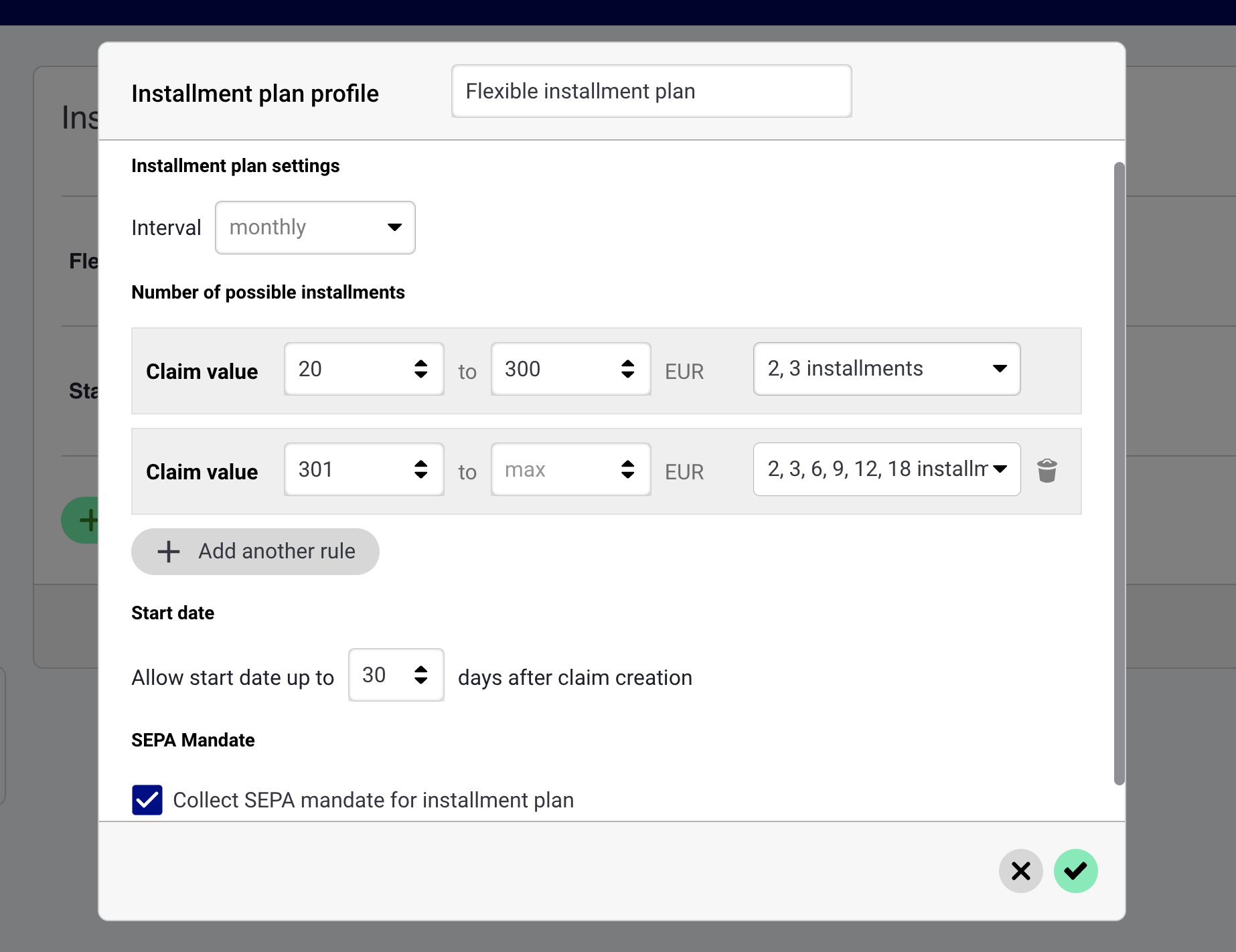

Defining the available installment plan options

- You can define different installment plan options in the settings. For one customer group, you can offer e.g. only 2 and 3 installments and a start date within the next 14 days. For another customer group, you can e.g. offer to choose from 2, 3, 6, 9, 12 and 18 months.

- The options you define and the customer can select from are dependent on the outstanding claim value. E.g. a higher claim value can get more installment options whereas smaller open amounts might only get a lower number of installment options to split the payment.

- One more thing to consider: Installment plan options can even differ in each step of the communication. (For example, you can decide that installation plans should not be offered in specific steps.)

Customer journey

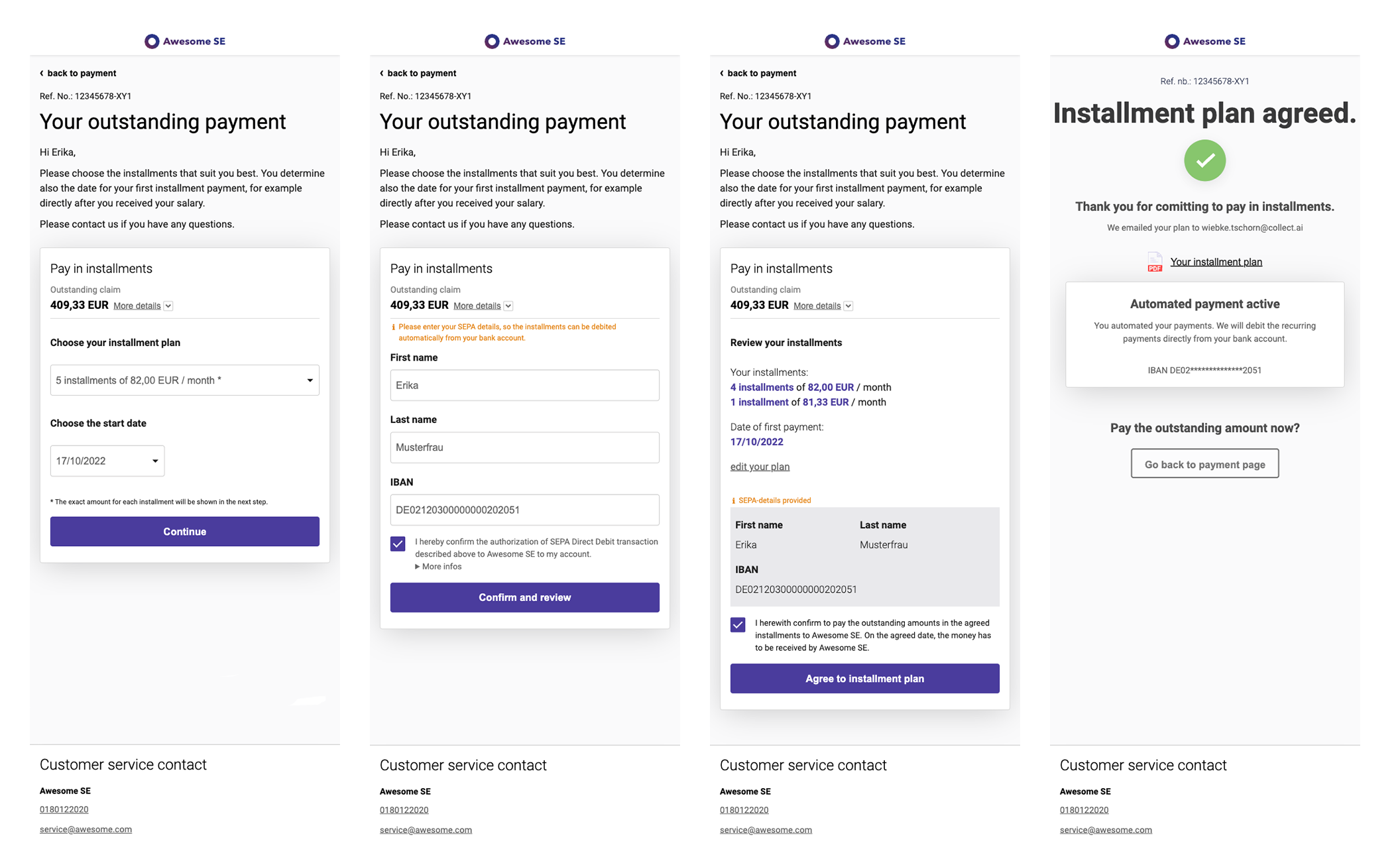

- Customers will receive a usual message via e-mail, SMS or letter to access the landing page.

- On the landing page, customers can choose the best fitting installment plan for them with a start date for the first payment.

- In addition to that, and optionally to be enabled, customers can or need to agree on a SEPA-mandate to automate the upcoming installment payments. If customers agree, you can direct debit all the installments with your usual DirectDebit process.

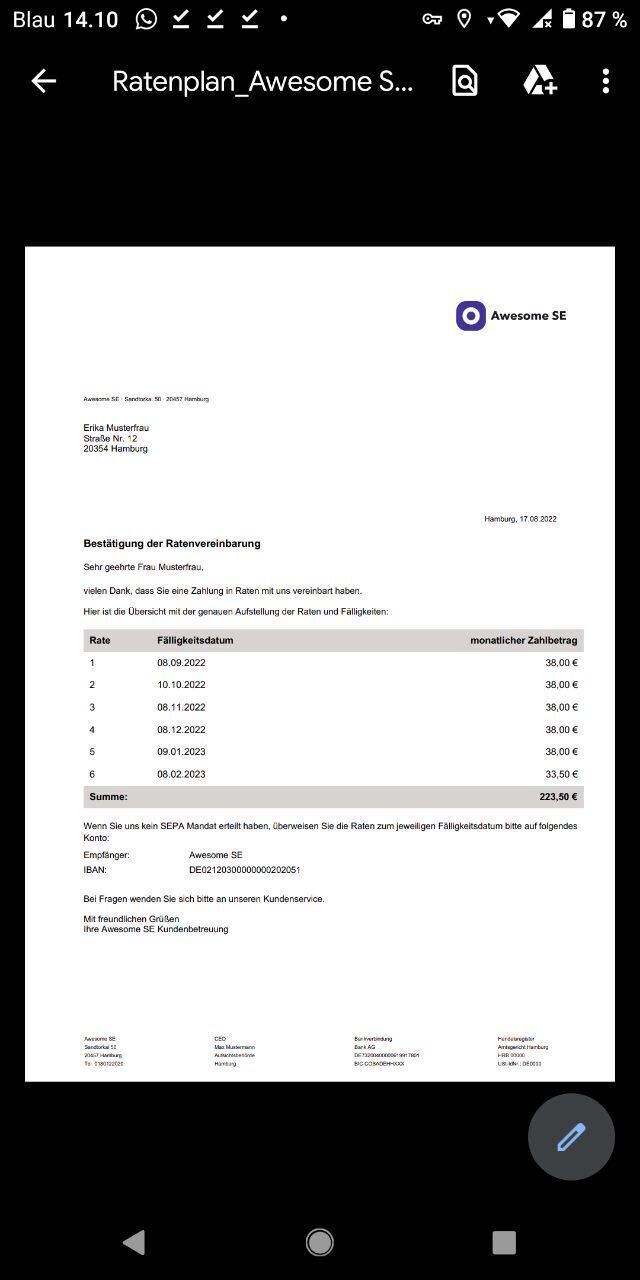

- After a successful agreement to an installment plan, an e-mail confirmation is sent immediately if the e-mail address is available and a PDF document can be downloaded with all information of the installment plan in written form.

A possible installment plan confirmation PDF downloaded using a mobile phone.

How does it affect the open claim?

As soon as a customer agrees to the installment plan, the claim will automatically be paused, and consequently, all further scheduled messages are paused. The customer can always access the downloadable PDF with the installment plan agreement information on the landing page when the claim is paused. Moreover, even if customers have agreed to an installment plan, they can still transfer the remaining outstanding amount at any time as soon as their liquidity improves. That’s why it is very important to keep the outstanding claim value up to date after each incoming payment from your customer to avoid any possible overpayments. Now, we need to distinguish between two possible cases:

- Payment success case: In the best case, the customer pays the regular installments, payments arrive and the outstanding amount is fully paid. You complete the installment plan (Complete installment plan) which will also complete the claim.

- Payment failure case: In case, an installment is not paid in time, you need to invalidate the installment plan: (Invalidate Installment Plan). By doing that, the claims communication process will automatically be resumed and the messages with the remaining outstanding amount will be continued to be sent out.

Data sharing

To reflect the agreed installment plan in your system and to fully automate your process, you need to process the event data. There are the following options:

- You can use our webhooks, the installment plan created webhook and the installment plan SEPA-mandate collected webhook.

- If you are using one of our standard connections into Powercloud or SAP, we can directly create the installment plan in your ERP system.

Data structure

Data structure of an installment plan

Each installment plan consists of the total installment plan data and the list of all installments. So, the full list can be shown in the confirmation e-mail and PDF to download. Please find an example in the installment-plan-created - webhook: installment plan created

Data structure of a SEPA Mandate for installments

The SEPA mandate includes the relevant information to execute a SEPA Direct Debit with your bank. This type of SEPA mandate is always recurring as an installment plan has at least two installments. Please find an example in the installment-plan-sepa-mandate-collected - webhook: installment plan SEPA mandate collected

What are the requirements to enable digital installment plans?

If you are already using the collect.AI platform and are creating and updating claims

- Define in the settings which installment plan options you would like to offer to your customers, e.g. 2, 3, 6 installments and 30 days as a start date and enable it in the scenario where it should be used.

- You need to define the texts for the confirmation e-mail, the downloadable PDF and the landing page. We’re happy to make suggestions.

- You need to process the installment plan data to reflect the agreement in your system.

- Decide if you like to enable SEPA mandate collection (as required or optional for the customer). If enabled, you need to process the SEPA Direct Debit data, too.

If you are a new user to the collect.AI platform, please contact us to get you started.